Every industry is seeing drastic changes in how they operate their business; ARM is no exception. Depending on your industry, things can fluctuate quickly or stay at the same pace for years. However, in the wake of the pandemic, we have noticed a few significant trends in the ARM industry that collection agencies have seen in 2020 that are likely to continue in the future.

For that reason, here are the Top 5 ARM Trends of 2020

Top 5 ARM Trends of 2020

1) Increases in debt

Consumer debt continues to increase dramatically, and we can expect all types of debt to continue to rise during the first quarter of 2021 in the U.S.

Legislation and regulations have been proposed and enacted, mostly on the state and local levels, that shelter consumers from collection agencies and certain tactics.

ARM professionals should keep tabs on these shifts through organizations like the ACA International and expect increases in charge-offs and, in turn, more instances of debt that is less than three years old.

2) Alternatives to phone outreach adopted

The Federal Communications Commission (FCC) has issued stricter regulations on “robocalling” for several reasons. However, this has put many agencies at a disadvantage when communicating directly with their consumers.

Many collection agencies have seen this as an opportunity to augment phone calls with alternative channels for reaching them. For example, several have turned to Interactive Voice Response (IVR) systems, which are automated systems where consumers can use voice prompts and touchtone responses to complete various tasks, including making payments.

3) Digital technology is booming

In a work-from-home world, providing technology tools for both agents and consumers is essential. Agencies have had to move fast to deploy remote working technologies. The good news for consumers is that online payment portals were already live to make self-serve payments and manage their accounts.

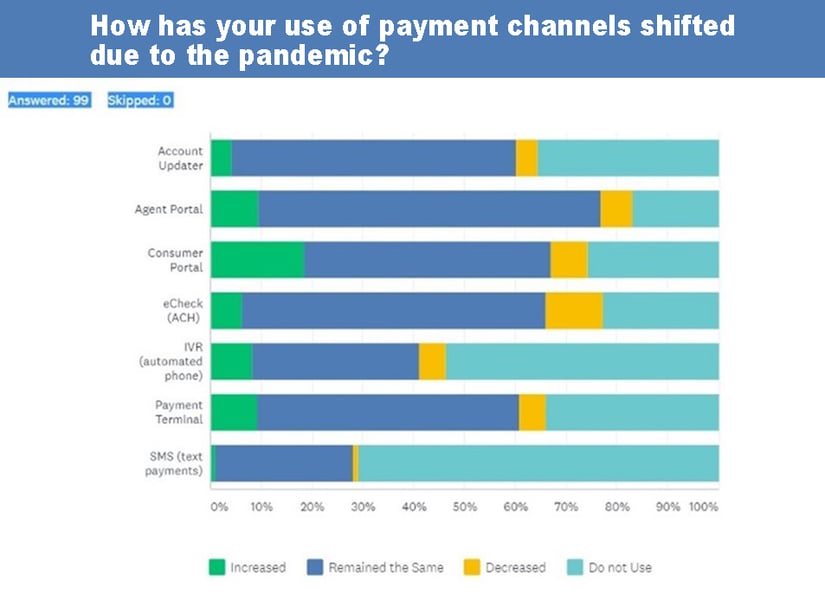

A recent survey REPAY deployed to ARM companies found that consumer payment portals saw the most significant increase in payment channels due to the pandemic.

4) Ancillary Integrations Just as Important as the Core

Collection agencies live and die by their core systems. It is the backbone of a thriving, successful agency. But sometimes it’s easy to lose sight of the importance of technology integrations, which increase the core’s power.

For example, payment processors have native integrations that connect seamlessly to all the major core systems in the ARM industry. You may not know that tech-enabled payment providers like REPAY also have open APIs and extensive technology staff, making it possible to offer multiple integrations, even custom ones. This effectively makes it impossible for a core system to shut them off.

5) Compliance is more important than ever

With this influx of home agents and online users, many ARM businesses are looking to improve their security and compliance. This doesn’t just mean checking the box on becoming compliant; it also means partnering with other fully compliant organizations.

In the ARM space, with ever-changing regulations, legislation, breaches, and security issues, it’s critically important to partner with organizations that have a strong track record working with collection agencies so they can anticipate problems before they even happen. Providers that do not know or understand the nuances of the industry automatically put you at risk.

Key Takeaways

In general, the industry is shifting to more digital and online solutions. Many collection agencies don’t have the most current technologies required to collect payments online and handle consumers virtually.

Companies like REPAY have built a reputation in the ARM industry, helping businesses like yours provide secure, reliable, and convenient payment solutions for nearly 20 years. We understand the ARM industry and were 100% committed to the success of our clients. If you ever have any questions about payment technology, compliance, or any hot trends you’ve been following, please feel free to reach out with any questions.